2 Recession-Proof Stocks to Beat the 2025 Slowdown

While many economists and investors initially expected 2025 to be another good year, the outlook in America has soured rapidly as steep tariffs and a softer labor market appear set to increase prices and curtail growth.

Recently, JPMorgan Chase analysts raised their predicted recession risk for the year from 30% to 40% due largely to America’s emerging trade wars. » Read more about: 2 Recession-Proof Stocks to Beat the 2025 Slowdown »

Read More

Palantir Soared 20.5% But Is It Just The Start?

Palantir Technologies (PLTR) has been in business for 20 years but it’s only recently that it’s accomplished one of its most impressive feats to-date, tripling the number of users of its artificial intelligence platform in a single quarter.

That spike in demand translated to a spectacular Q3 that blew away Wall Street’s expectations.

» Read more about: Palantir Soared 20.5% But Is It Just The Start? »

Read More

Spotlight: Buffett Buys Real Estate Colossus

Few names are as prominent in real estate as D.R. Horton (NYSE:DHI) but when you couple a top homebuilder with the investing legend Warren Buffett taking a position in it, you’ve got an investment opportunity that demands further scrutiny.

With rising mortgage rates and waning home sales, buying a homebuilder seems an unusual play,

» Read more about: Spotlight: Buffett Buys Real Estate Colossus »

Read More

Spotlight: The Next Bloomberg Terminal?

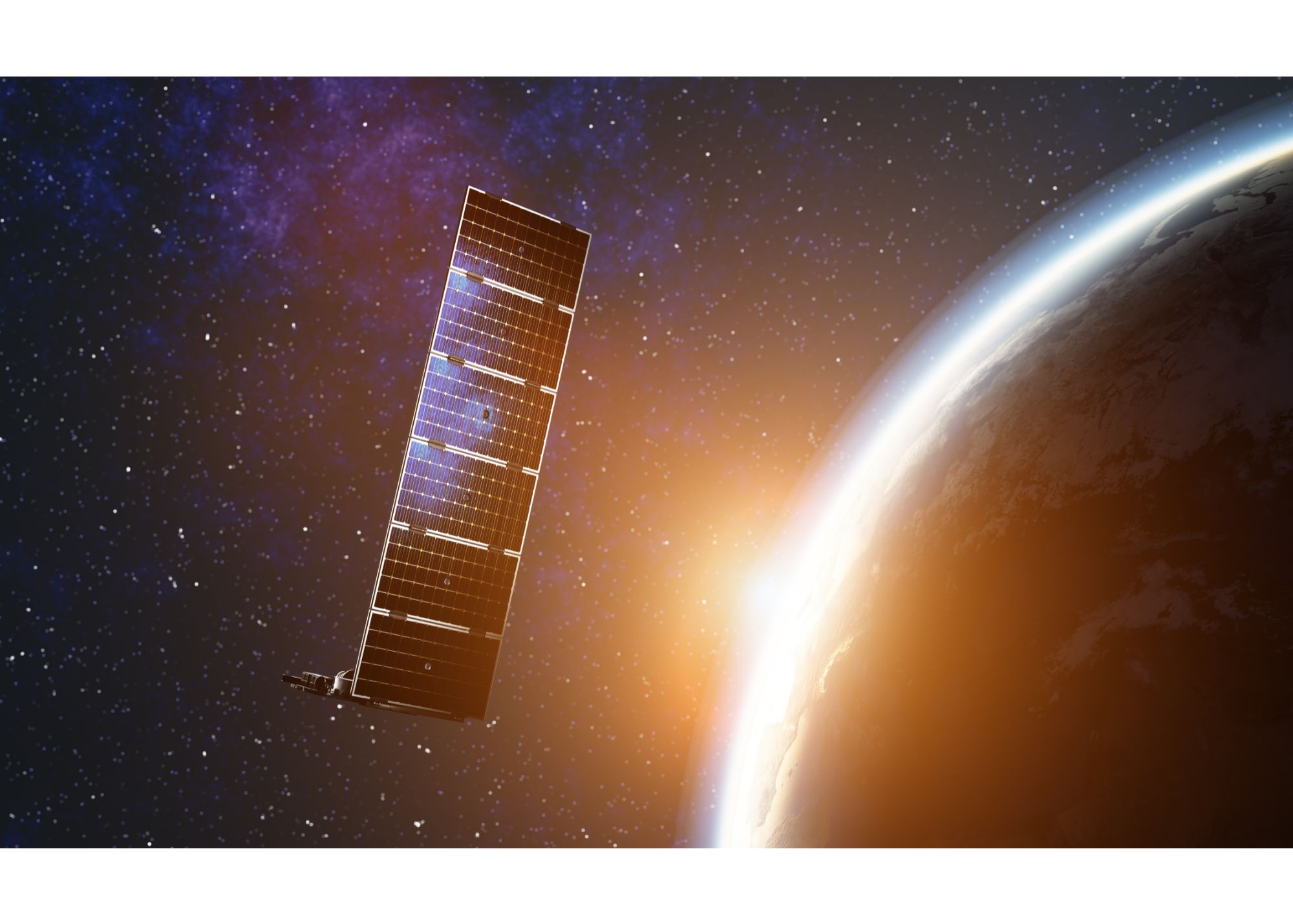

Did you know that every 24 hours, Planet Labs captures imagery of every corner of the Earth? This trove of data is so extensive that it helped track a rogue Chinese spy balloon all the way back to its point of origin.

Similar to a search engine, Planet Labs aims to organize massive amounts of Earth-related data.

» Read more about: Spotlight: The Next Bloomberg Terminal? »

Read More3 Safe-Haven Stocks to Buy Now as the Market Sells Off

With the S&P 500 now in correction and stocks selling off quickly, investors are understandably looking for safe-haven stocks to preserve their capital and keep their portfolios guarded from potentially turbulent market conditions ahead.

Luckily, there are still several companies that could offer some degree of security. Among the safest stocks to buy now for both current security and potential long-term returns are Abbott Labs,

» Read more about: 3 Safe-Haven Stocks to Buy Now as the Market Sells Off »

Read MoreThe Burst

The Giant at the Intersection of AI, Networking and Software

Broadcom isn’t just another chipmaker riding the semiconductor cycle, it’s a carefully assembled portfolio of some of the stickiest, most profitable businesses in tech.

At its core, Broadcom has mastered the art of acquisition, folding niche leaders into its empire, stripping out inefficiencies, and using the resulting free cash flow to fuel dividends,

» Read more about: The Giant at the Intersection of AI, Networking and Software »

Read MoreThe Ivy

Why Realty Income May Be Standing on the Edge of a Major Comeback

Over the past decade, the S&P 500 has rocketed more than 4x but Realty Income, a mere 2x and change. Not disastrous, you’d still have more than doubled your money, but far from spectacular. Yet this may be exactly where the story gets interesting.

After years of lagging, the company known as “The Monthly Dividend Company” could be sitting at an inflection point,

» Read more about: Why Realty Income May Be Standing on the Edge of a Major Comeback »

Read MoreThe Daily

Warren Buffett vs. Bill Ackman: One Piled Into Amazon While the Other Sold

It’s always interesting to see two great investors take opposite sides of an investment.

Investors are unlikely to find two more closely followed investors than billionaires Warren Buffett and Bill Ackman. Buffett, arguably the greatest investor of all time, ran the large conglomerate Berkshire Hathaway for roughly six decades until stepping down as CEO at the end of 2025.

» Read more about: Warren Buffett vs. Bill Ackman: One Piled Into Amazon While the Other Sold »