The Single MOST Important Number for Amazon

Following the company’s second-quarter report, Amazon (AMZN) stock surged, but not because of its e-commerce business.

Amazon’s growth rate slowed, and the company took a loss in e-commerce. However, its cloud services business, Amazon Web Services (AWS), reported a 36% jump in operating income.

Amazon proved long ago that it’s not a one-trick pony. Thanks to AWS, Amazon’s financial position looks stronger than ever. But is it a mirage? If there was just one thing you need to know before investing in Amazon, what is it?

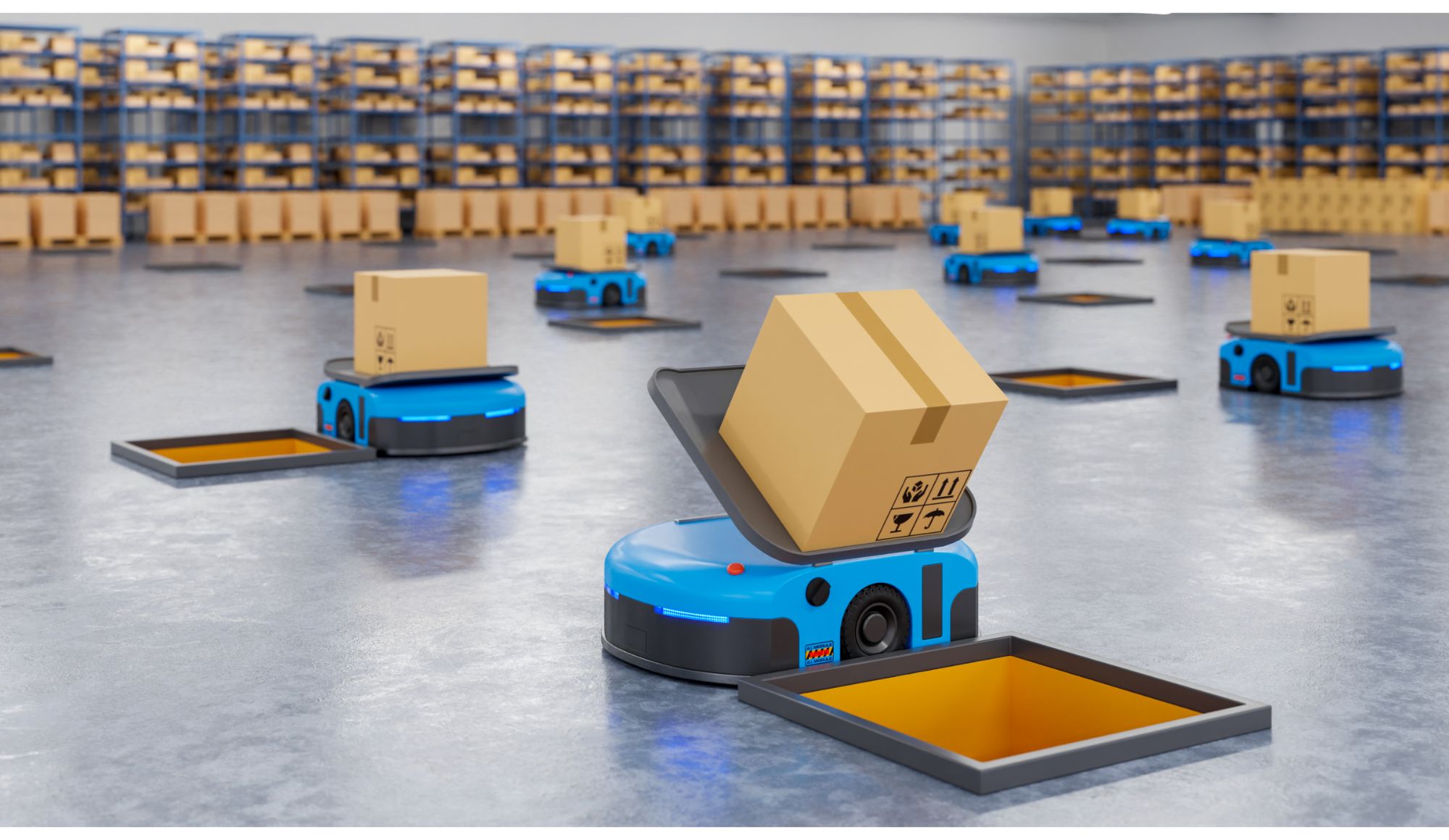

Amazon Is More Than an Online Retailer

Year to date, shares of Amazon are down double-digits in percentage terms. However, they increased by more than 27% over the past month, following Amazon’s latest quarterly report. Although the company is now dealing with macroeconomic headwinds, investors were quickly reminded of why Amazon is a winning bet.

Even in this tough environment, Amazon beat both analysts’ expectations and its own guidance.

Net sales increased 7% to $121.2 billion. While operating income of $3.3 billion was down from $7.7 billion compared to last year’s second quarter, that figure exceeded the company’s projection of negative $1 billion to $3 billion. A drop had been anticipated as shopping habits started to move away from e-commerce.

Amazon’s operating loss gives the appearance that growth is slowing, but there’s more to the metric than meets the eye. Surging growth within Amazon’s cloud infrastructure business has investors excited about what the future holds for the company. In Q2 of 2022, AWS pulled in $19.7 billion in net sales and over $5.7 billion in operating income.

In the first six months of 2022, AWS produced operating income in excess of $12.2 billion, which made it more profitable than nearly any other American company. Moving forward, the cloud division’s operating income is the most important number for investors to keep an eye on.

Amazon Remains a Safe Long-Term Bet

In 2021, Amazon’s share of U.S. e-commerce sales reached an all-time high of 56.7%, driving up the company’s stock price.

Now that brick-and-mortar stores are busy again, online shopping platforms are feeling the pressure. Despite this, net sales from Amazon’s online retail business remain the greatest contribution to the company’s overall revenue, even though there was zero growth this past quarter.

Since net sales from Amazon’s online stores and third-party seller services were $50.8 billion and $27.4 billion respectively, online retail still dominates the company’s top line.

Amazon revenues don’t stop there; the company is highly diversified. From Amazon Prime to AWS, the enterprise has several revenue streams. Sure, the e-commerce figures were less than stellar last quarter as Amazon faces headwinds but expect Amazon to lead the market when the economy bounces back.

Above all, the growth potential of AWS ensures the future looks bright for AMZN shareholders for years to come.

Does Amazon’s More Accessible Price Make It a Buy?

On June 6, 2022, AMZN completed its 20-for-1 stock split, the first split since 1999. For those without access to fractional shares, this split was a game-changer. Individual shares became much more affordable, but is that reason enough to buy?

Amazon’s diversification will be a critical driving force moving forward; the company has a hand in many industries outside of e-commerce.

This level of diversification could be a disadvantage for smaller companies that might spread themselves too thin — but not for Amazon, which continues to become a leader in nearly every industry it enters. For example, Amazon Prime now offers one of the leading streaming services, and AWS is leading the cloud computing space, beating out both Google and Microsoft.

Even with a 40% decrease in operating cash flow, Amazon still reported $35.6 billion in available cash for Q2 2022. This access to liquidity means Amazon has the funds to pursue multiple business avenues, fueling its long-term potential.

Amazon is one of the few companies whose market cap exceeds $1 trillion and remains in high-growth mode. AWS’ growth runway and healthy margins will significantly contribute to Amazon’s future sales and earnings making it a compelling buy.

All things considered, it looks like Amazon’s growth days are far from over, making it an attractive time to buy in — and the company’s stock split is the icing on the cake making it even more affordable to buy in.