Is PayPal About to Stage an AI-Powered Comeback

Shares of PayPal haven’t joined the tech sector’s rally. While the S&P 500 has climbed, PayPal has slipped about 15% over the past year. But a new partnership with OpenAI and strong underlying fundamentals could mark the start of a rebound.

Key Points

-

PayPal’s integration into ChatGPT positions it as the default payment option for AI-powered shopping—an early lead in conversational commerce.

» Read more about: Is PayPal About to Stage an AI-Powered Comeback »

Read More

Is It Finally Time to Buy Walgreens?

Walk into just about any town in America, and chances are you’ll spot a Walgreens. The pharmacy chain is one of the most ubiquitous retail brands in the country, with over 8,000 locations across the U.S. alone.

But while its storefronts are everywhere, the same can’t be said for investor confidence in its stock.

» Read more about: Is It Finally Time to Buy Walgreens? »

Read More

Is Buffett’s Favorite Stock Finally a Buy?

Berkshire Hathaway (NYSE: BRK.B) has dipped from its record highs earlier this year, and the pullback has some investors wondering: Is this the beginning of something more serious or a golden opportunity in disguise?

With shares of the B class now trading below the $490 mark, the question becomes not whether the stock is cheap in a traditional sense,

» Read more about: Is Buffett’s Favorite Stock Finally a Buy? »

Read More

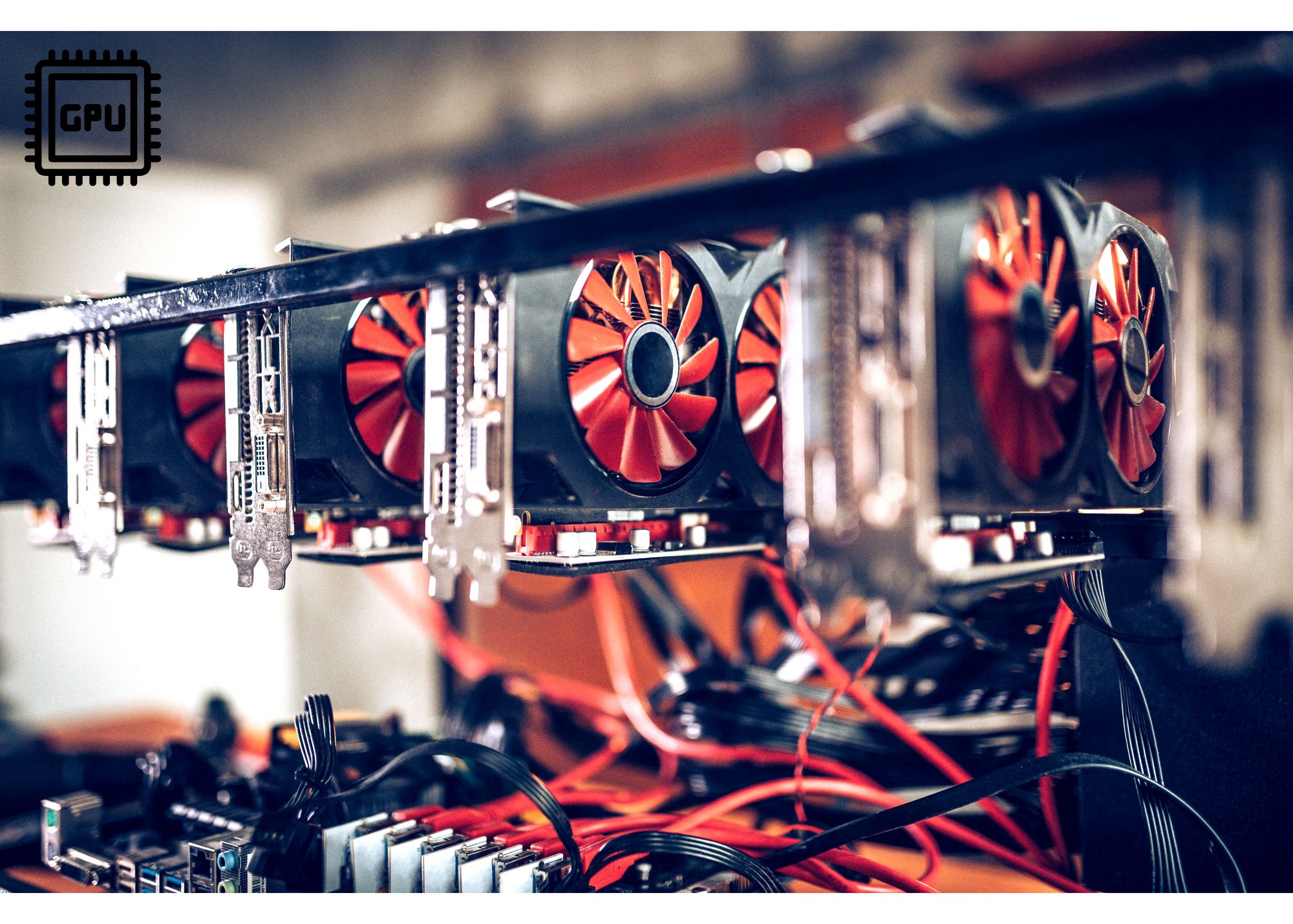

Could Nvidia Be the First $10 Trillion Company?

Nvidia might have started as a gaming chip company, but make no mistake it’s now the backbone of the AI revolution.

And if smart money projections hold up, it could become the first company to smash through the $10 trillion valuation barrier. That’s not hyperbole, it’s a plausible trajectory grounded in stunning financials,

» Read more about: Could Nvidia Be the First $10 Trillion Company? »

Read More

Will Prediction Markets Disrupt DraftKings?

DraftKings and FanDuel have long dominated U.S. online sports betting, thanks to their early entry via daily fantasy sports.

That first-mover advantage, combined with cutting-edge technology and deep brand recognition, let both companies capture the lion’s share of the market as sports betting rolled out state by state.

But a new kind of competitor is emerging that could rewrite the rules of online wagering.

» Read more about: Will Prediction Markets Disrupt DraftKings? »

Read MoreThe Burst

IBM’s Smart Move To Prove It’s an AI Powerhouse

For years, IBM has worn the “missed opportunity” label in artificial intelligence. The company that built Deep Blue, the chess-playing computer, and Watson, the supercomputer, seemed perfectly positioned to dominate AI before anyone else saw it coming.

And yet, while those early breakthroughs made headlines, IBM failed to cash in.

» Read more about: IBM’s Smart Move To Prove It’s an AI Powerhouse »

Read MoreThe Spotlight

Is This 8.6% Yield Too Good to Ignore?

If you’re the kind of investor who wants steady income, especially the kind that drops into your account every month like clockwork, the JPMorgan Equity Premium Income ETF (JEPI) is tough to ignore.

The headline number is eye-catching, an 8.6% trailing yield, paid monthly. That’s not just high, it’s more than four times the yield of the S&P 500 and well above what most high-grade corporate bonds are paying right now.

» Read more about: Is This 8.6% Yield Too Good to Ignore? »

Read MoreThe Daily

Why Retirees Who Only Own ETFs May Be Missing a Key Income Layer

Exchange-traded funds have earned their place in retirement portfolios as they are diversified, low-cost, and easy to manage. For retirees who don’t want to spend their mornings picking stocks, ETFs like the Schwab US Dividend Equity ETF (NYSE:SCHD) or the Vanguard High Dividend Yield ETF (NYSE:VYM) offer instant access to hundreds of dividend-paying companies in a single holding.

» Read more about: Why Retirees Who Only Own ETFs May Be Missing a Key Income Layer »