Up 94% Will This Semi Stock Keep Soaring?

Semiconductor and data infrastructure company Marvell Technology (NASDAQ:MRVL) absolutely trounced the market last year by a factor of over 3x, delivering a trailing 12-month return of almost 94%.

While the stock was rising gradually all year, the company’s shares soared in early December and finished the year extremely strong.

Why are Marvell shares rising, » Read more about: Up 94% Will This Semi Stock Keep Soaring? »

Read More

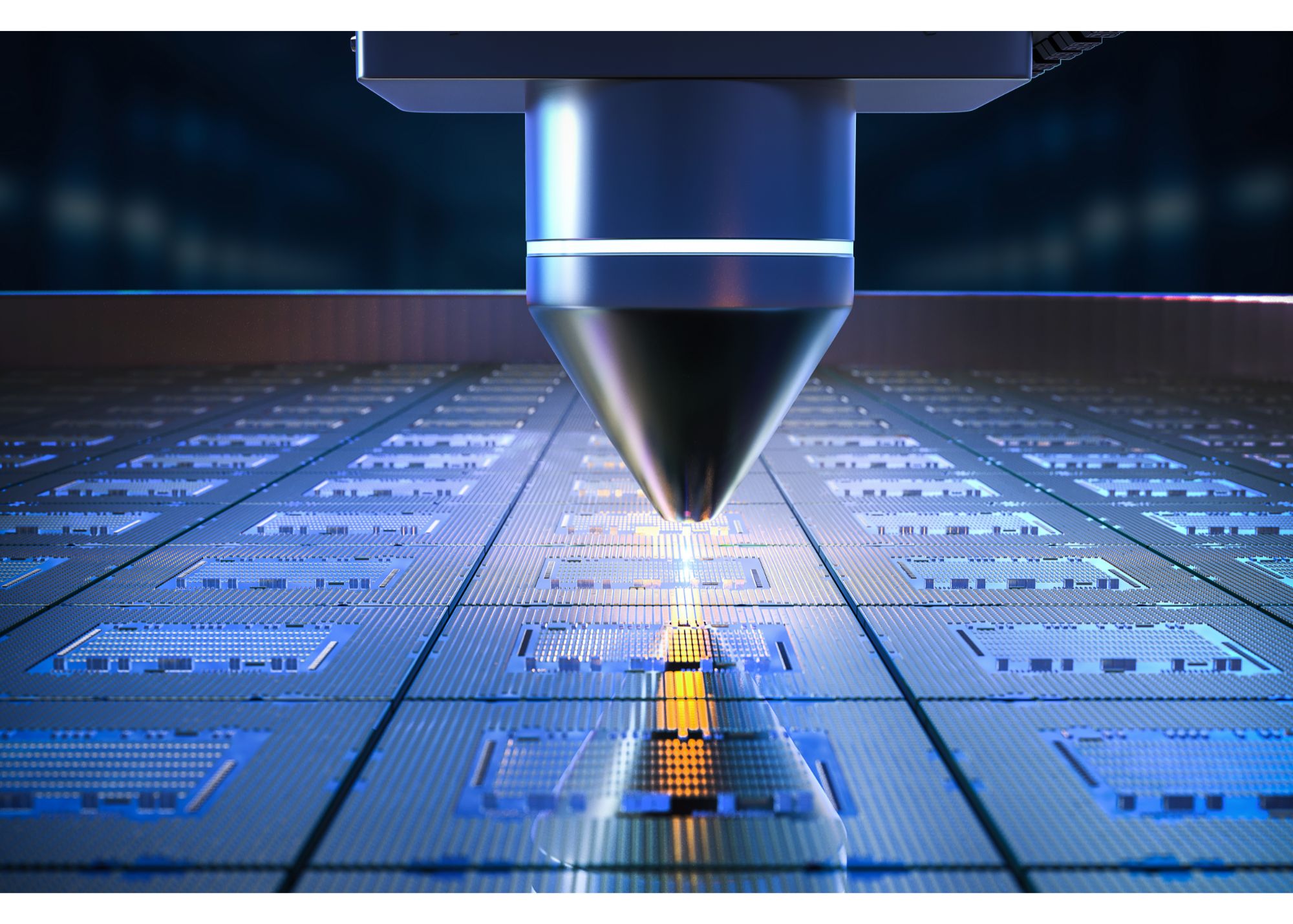

Intel Horror Reveals Danger for Market

Predicted to reach a staggering trillion-dollar market size this year, the semiconductor industry has enjoyed a decade of continuous growth. Although high demand fuels the industry, supply constraints have challenged company financials.

Intel’s latest earnings report has given pause not only to its own shareholders but also to those of Nvidia and AMD.

» Read more about: Intel Horror Reveals Danger for Market »

Read More

Billionaire Bets 16.1% of Portfolio on 1 Energy Stock

Billionaire David Tepper has taken big stakes in some of the best known companies on earth. He’s bet 14.1% of his portfolio on Alphabet, 12.0% of it on Amazon, and 8.7% on Meta. Surprisingly though, none of those tech bellwethers eclipse his top holding in a single energy company, Constellation Energy. He’s put an astonishing 16.1% of his portfolio into this one energy stock,

» Read more about: Billionaire Bets 16.1% of Portfolio on 1 Energy Stock »

Read More

MAJOR ALERT: Within 7 Days, Market Plunges?

There’s blood in the water and a shark has sniffed it out and is swimming furiously to capture some some pounds of flesh.

What are we talking about?

A major bet was placed by one of Wall Street’s iconic traders betting that by Friday, February 17, the market would fall,

» Read more about: MAJOR ALERT: Within 7 Days, Market Plunges? »

Read More

1 Defense Contractor Going Global

Lockheed Martin Corporation (NYSE:LMT) is doing very well and making great progress with its 21st Century Security® strategy. The bold plan concentrates on three main initiatives that aim to boost the company’s role in the defense and aerospace industries.

The first initiative focuses on making Lockheed Martin’s production system stronger and able to handle more.

» Read more about: 1 Defense Contractor Going Global »

Read MoreThe Burst

I Finally Found an 8% Yielder

Real estate, REITs, dividend stocks, you name it. I’m always looking for new ways to make my money work while I sleep. And one stock I found that’s super interesting for passive income is Main Street Capital (NASDAQ: MAIN).

It has the hallmarks of being one of the best passive income machines I’ve seen,

» Read more about: I Finally Found an 8% Yielder »

Read MoreThe Ivy

Why Bitcoin’s Path to $1 Million May Be More Realistic Than You Think

With a market cap north of $2.2 trillion, more than half the value of every cryptocurrency combined, Bitcoin is a financial phenomenon.

But one of its most outspoken champions, Strategy co-founder Michael Saylor, doesn’t think Bitcoin’s story has even started. In fact, his latest forecast makes today’s price tag look like pocket change.

» Read more about: Why Bitcoin’s Path to $1 Million May Be More Realistic Than You Think »

Read More