You Can’t Pick Tesla, So Which EV Wins?

Few realize that Lucid Group (NASDAQ: LCID) traces part of its engineering DNA back to Atieva, a company that initially specialized in developing advanced battery systems for Formula E racing teams. Before the high-profile splash of the Lucid Air sedan, Lucid’s engineers were quietly perfecting electric drivetrains in the crucible of motorsports.

This racing pedigree helped the company engineer a powertrain that offers truly impressive range—up to 516 miles on a single charge for the Lucid Air Grand Touring edition, » Read more about: You Can’t Pick Tesla, So Which EV Wins? »

Read More

CLEAR to Take Off: 1 Stock with Massive Market Size

Clear Secure, or CLEAR, is a member-centric secure identity platform that is striving to revolutionize how people verify their identity wherever they go.

CLEAR generates revenue through its consumer aviation subscription service, CLEAR Plus, which provides members with fast and predictable experiences at airport security checkpoints across the country through the use of touchless biometric verification technology.

» Read more about: CLEAR to Take Off: 1 Stock with Massive Market Size »

Read More

Why You MUST Own Blue-Chip Stocks

Some of the most tried and true investing strategies can make buying stocks less risky over time. Among the best strategies is blue chip investing: buying stocks of well-known companies with solid financial track records.

These stocks have several competitive advantages. While they are not immune to market downturns,

» Read more about: Why You MUST Own Blue-Chip Stocks »

Read More

Scintillating Growth Stock Scooped Up by Billionaire

Stanley Druckenmiller, net worth $6.4 billion, is widely considered one of the world’s best investors. His biggest claim to fame is the fact that in its 30 years of operation, Druckenmiller’s hedge fund Duquesne Capital never had a down year.

Druckenmiller closed his hedge fund after the global financial crisis and opened a smaller,

» Read more about: Scintillating Growth Stock Scooped Up by Billionaire »

Read More

Why Is Buffett Pouring Into This High Yield Bet

2024 has been a surprising year for Warren Buffett and Berkshire Hathaway. The company became the first American business outside of the tech sector to achieve a $1 trillion valuation, and an unusually buoyant stock market has caused many of its holdings to gain substantially in value.

Despite these successes, Buffett personally appears to be turning bearish.

» Read more about: Why Is Buffett Pouring Into This High Yield Bet »

Read MoreThe Burst

Could This Tiny Nuclear Company Power the Future of Data and AI?

NuScale Power (NYSE: SMR) isn’t your typical energy company. It’s a trailblazing player in nuclear innovation, aiming to rewrite how the world generates clean, consistent power. Rather than betting on sprawling, billion-dollar nuclear facilities, NuScale is going small, really small, with its modular reactors, designed to be trucked in and switched on as needed.

It sounds futuristic.

» Read more about: Could This Tiny Nuclear Company Power the Future of Data and AI? »

Read MoreThe Ivy

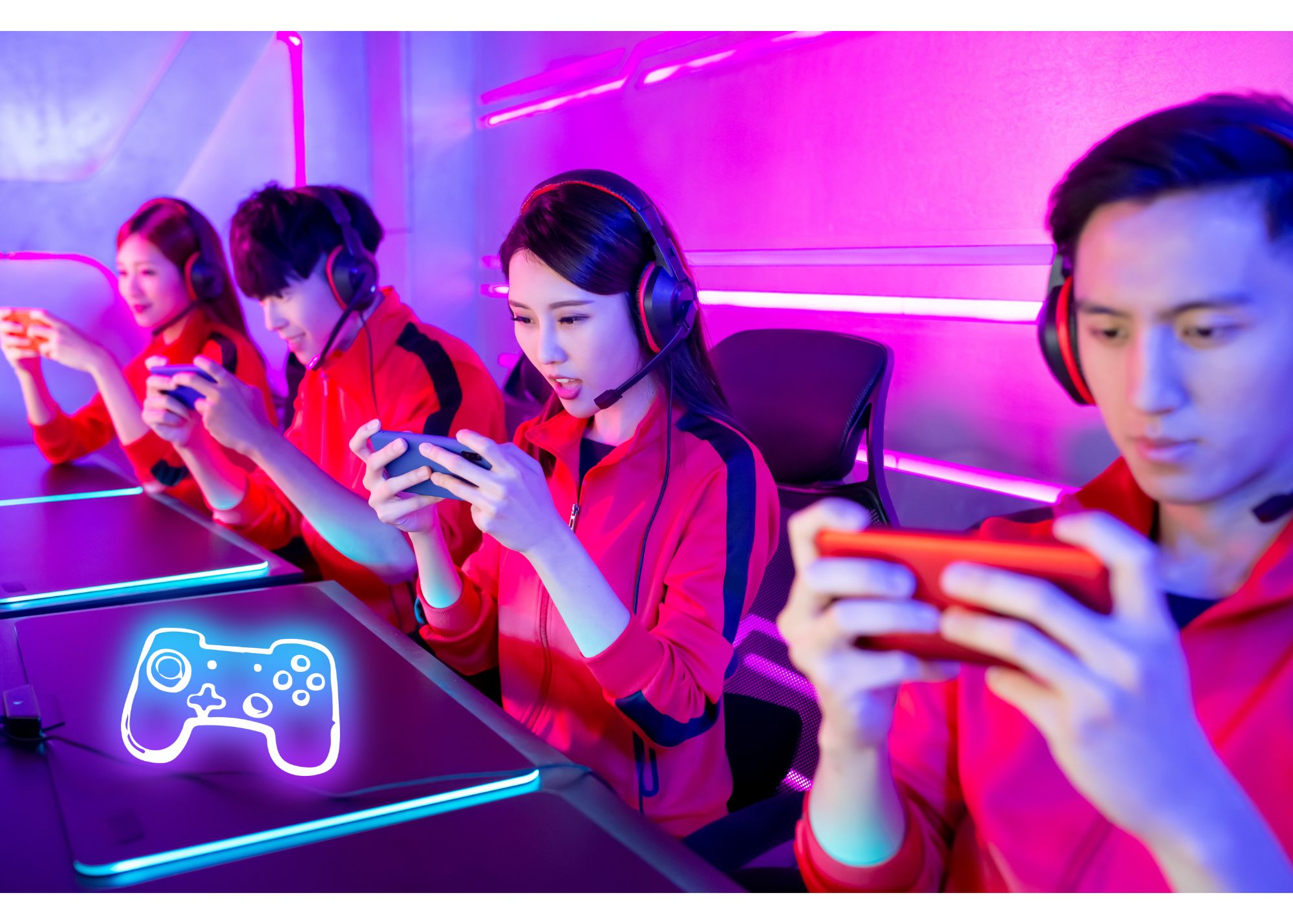

Is AppLovin Still a Buy After Its Incredible Run?

AppLovin (NASDAQ: APP) has had the kind of year investors dream about. The mobile app marketing and advertising platform, best known for its strength in mobile gaming has seen its stock rocket more than 5x over the past 12 months, fueled by relentless revenue growth and eye-popping profits.

With a move that big,

» Read more about: Is AppLovin Still a Buy After Its Incredible Run? »

Read MoreThe Daily

Cathie Wood Is Buying Up AMD Stock. Should You?

Cathie Wood’s ETFs bought more than 30,000 shares of AMD (AMD) last week. With AMD’s AI chip business flourishing, its overall revenue growing rapidly, and its stock changing hands at a relatively low valuation, AMD stock looks attractive for investors.

Based in Santa Clara, California, AMD develops semiconductors that are used in computers,

» Read more about: Cathie Wood Is Buying Up AMD Stock. Should You? »