Birkenstock Is Bouncing, Should Long-Term Investors Stay the Course?

Birkenstock sandals may be designed for comfort, but since going public, Birkenstock stock (NYSE: BIRK) has delivered more of a roller coaster than a relaxing stroll.

Over the past 12 months, shares have swung from gains in the mid-teens to losses twice that size, and as of today, they’re sitting roughly 8% in the red.

» Read more about: Birkenstock Is Bouncing, Should Long-Term Investors Stay the Course? »

Read More

Billionaire’s Warning to Wall Street

Recently, billionaire David Tepper went on CNBC to declare that the moves by China’s equivalent of the Federal Reserve to stimulate their economy amounted to a “buy everything” call.

Similar to how we stated “buy everything” in US markets back in 2010 when the Federal Reserve announced their commitment to do whatever it took to stimulate the US economy,

» Read more about: Billionaire’s Warning to Wall Street »

Read More

1 Stock To Survive Any Market

Amid increasing uncertainty, investing in an industry resilient to economic downturn, such as the automotive sector, might be wise. The sector has shown enduring strength over time and typically bounces back from periods of economic downturn. Its strength is predicted to continue, and it is ready for progress and invention until 2035.

» Read more about: 1 Stock To Survive Any Market »

Read More

Forget NVIDIA, Buy This AI Stock?

Oh sure, NVIDIA may get the headlines but perhaps an under-the-radar AI play is where your attention should be flowing.

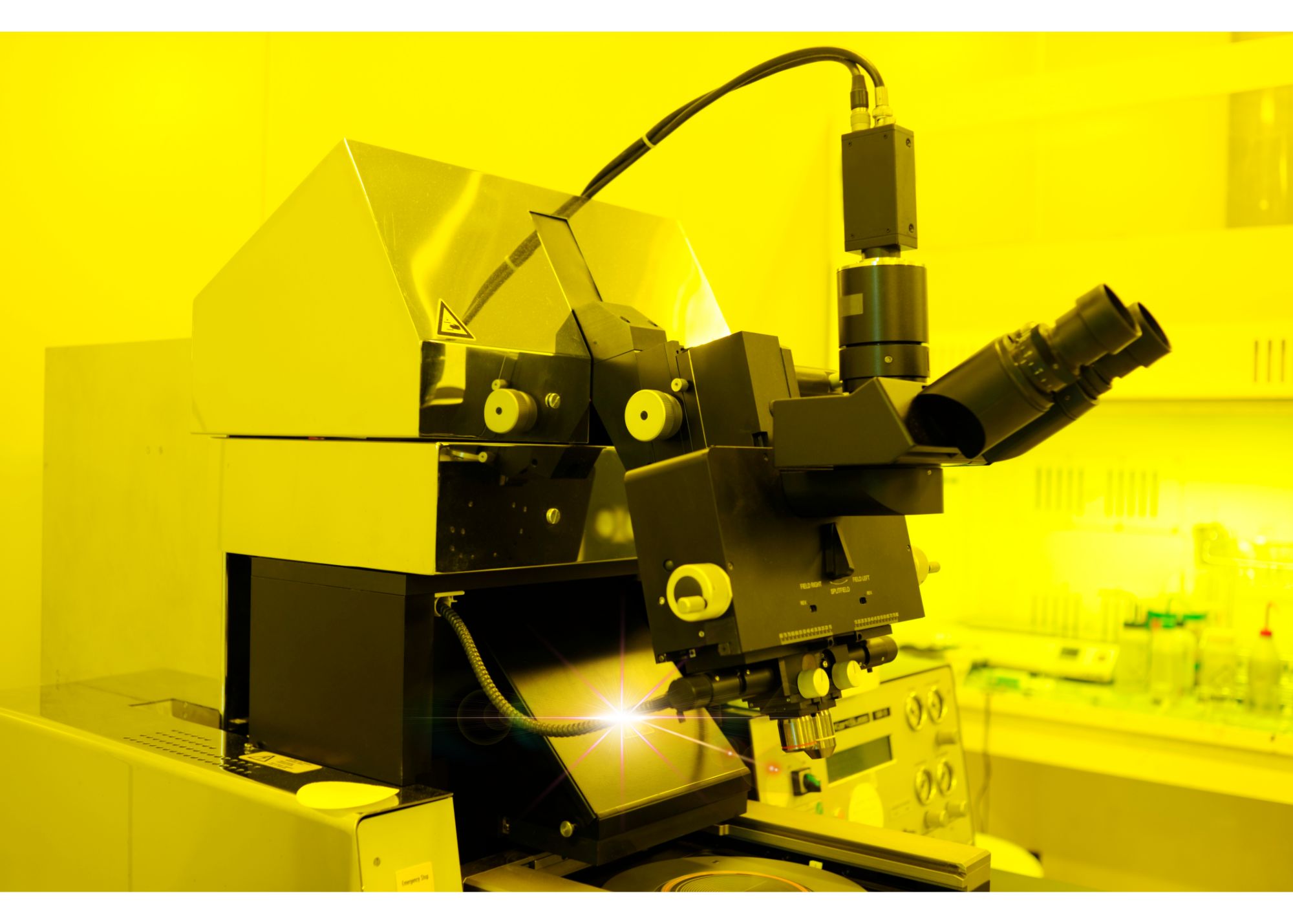

ASML (NASDAQ:ASML) is the only company in the world that produces extreme ultraviolet lithography machines, a critical technology for the most advanced semiconductor manufacturing.

For TSMC, who is crucial in the semiconductor supply chain,

» Read more about: Forget NVIDIA, Buy This AI Stock? »

Read More

Could Nvidia Be the First $10 Trillion Company?

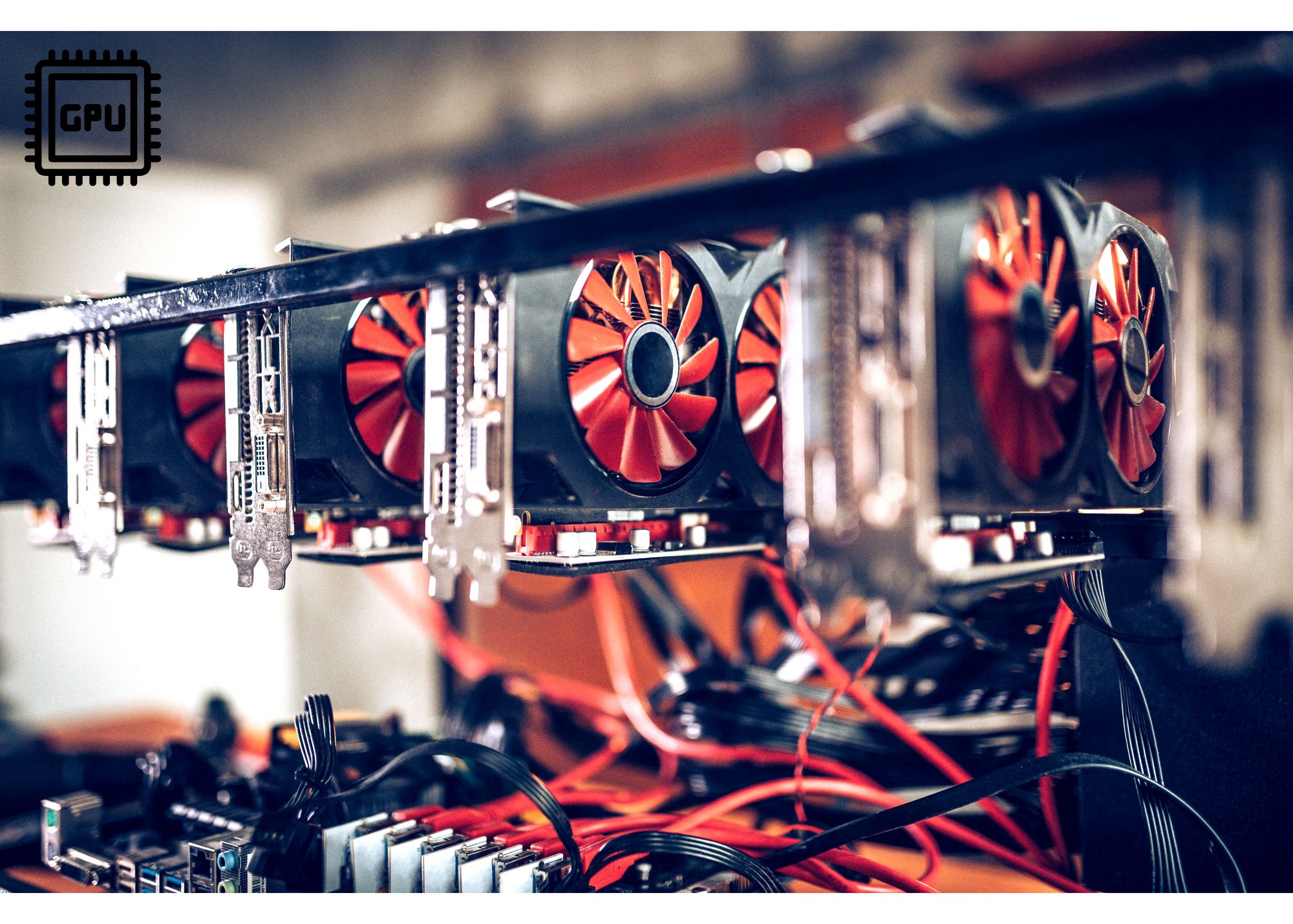

Nvidia might have started as a gaming chip company, but make no mistake it’s now the backbone of the AI revolution.

And if smart money projections hold up, it could become the first company to smash through the $10 trillion valuation barrier. That’s not hyperbole, it’s a plausible trajectory grounded in stunning financials,

» Read more about: Could Nvidia Be the First $10 Trillion Company? »

Read MoreThe Burst

Palantir Just Posted Blowout Earnings, So Why Did the Stock Tank?

On the surface, Palantir Technologies (NYSE: PLTR) is firing on all cylinders. Revenue is accelerating. Margins are expanding. The company just posted its sixth consecutive quarter of profitability, a first in its history. And yet, within hours of reporting one of its strongest earnings beats to date, the stock cratered by double digits.

So what gives?

» Read more about: Palantir Just Posted Blowout Earnings, So Why Did the Stock Tank? »

Read MoreThe Spotlight

Will This AI Stock Be the Ultimate Comeback Story?

SportRadar first came to the attention of most investors when the firm debuted on the public markets amid much fanfare a few years ago.

Then the hype surrounding the company was rooted in SportRadar’s role as a leader in sports data intelligence, which is key to the sports betting industry.

The company had formed a series of partnerships with major sports leagues and provided data to sportsbooks.

» Read more about: Will This AI Stock Be the Ultimate Comeback Story? »

Read MoreThe Daily

Dutch Bros' Stock Opened Friday With a 17.7% Jump, Then Gave It All Back. Here's Why.

Key Points

-

Dutch Bros beat Q4 revenue estimates by 5% and nearly doubled the Street’s earnings consensus.